About the project

Product -  mfcentral.com

mfcentral.com

Starting from June 2021, WebileApps have assisted two of our esteemed clients—KFintech and CAMS—with digitizing fund investing, one of the most rigid and procedure-intense niches. Our collaborative effort, MFCentral showed tremendous results in simplifying the procedural part of fund investment.

WebileApps was recommended to our clients as a company experienced enough to deliver complex projects end-to-end, covering every stage, from prototype to development to testing and further enhancements.

KFintech and CAMS are both Registrars and Transfer Agents (RTAs) approved and authorized by the Securities and Exchange Board of India (SEBI) to register detailed records of investor transactions related to mutual funds. This unprecedented collaboration between two RTAs simplified mutual fund operations and added transparency and order to the related processes. Yet it did pose considerable challenges for WebileApps as their technology partner.

Challenges

Technical challenges

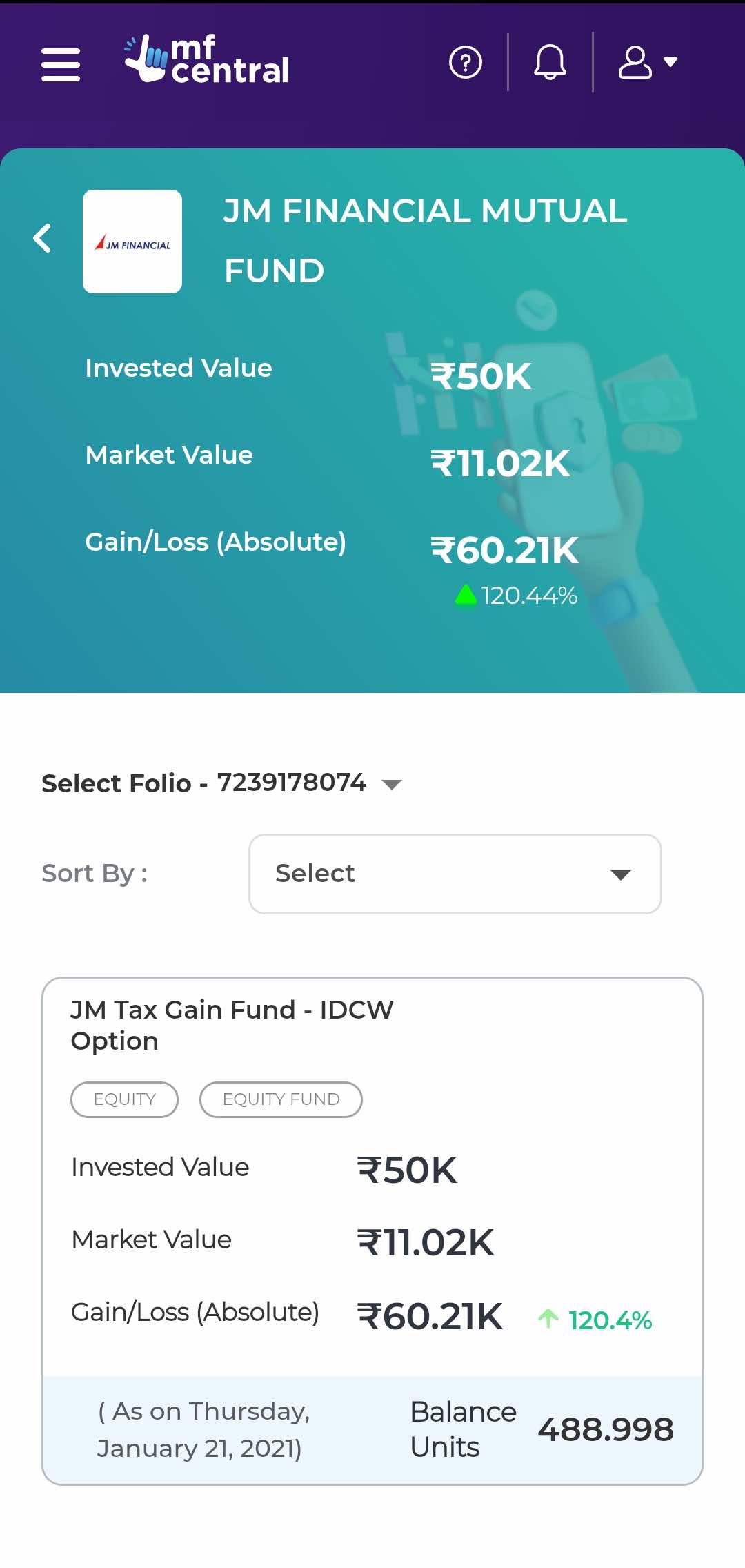

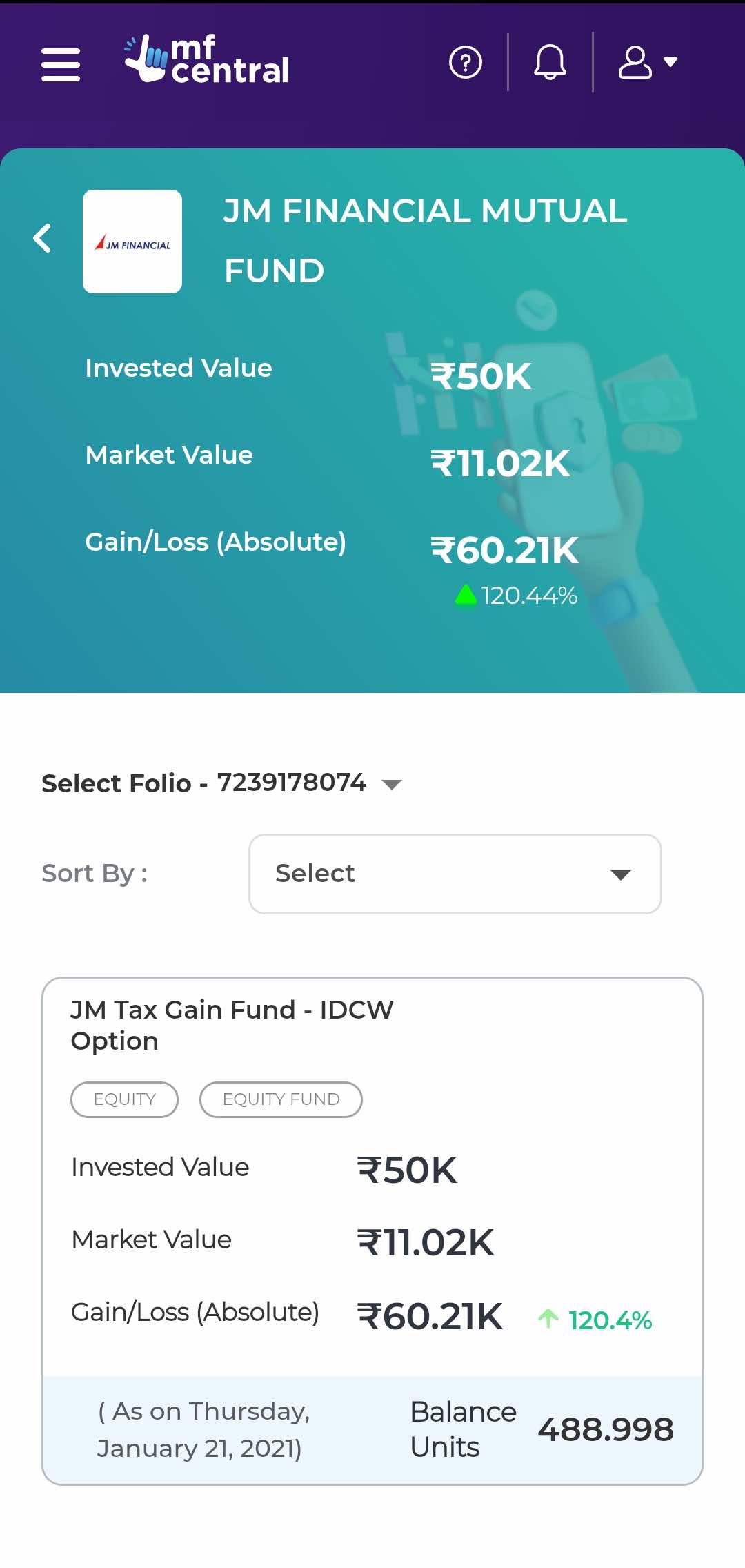

The Indian mutual fund landscape features 47 fund companies with their own investments and portfolio apps. It means that every company has a set of data tailored to their specific needs. On top of that, while some of the mutual fund houses might work with KFintech, others cooperate with CAMS, which makes the data-related matters even more complex.

To tackle this challenge, we built standardized API interfaces and middleware across multiple data sources. This way, we solved the data inconsistency issue by providing data to the new platform in a unified, consistent way without affecting the existing systems.

UI/UX challenges

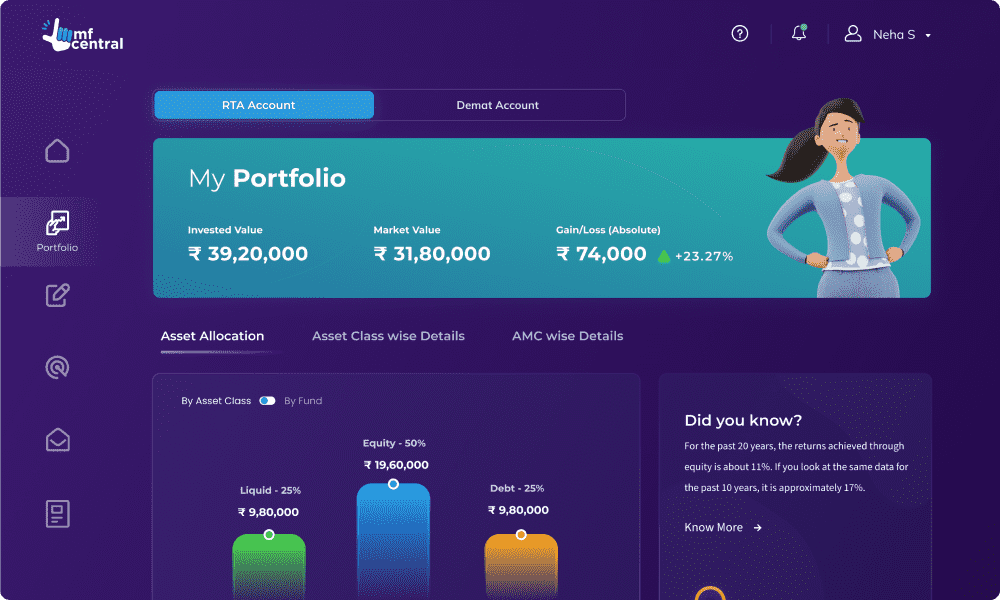

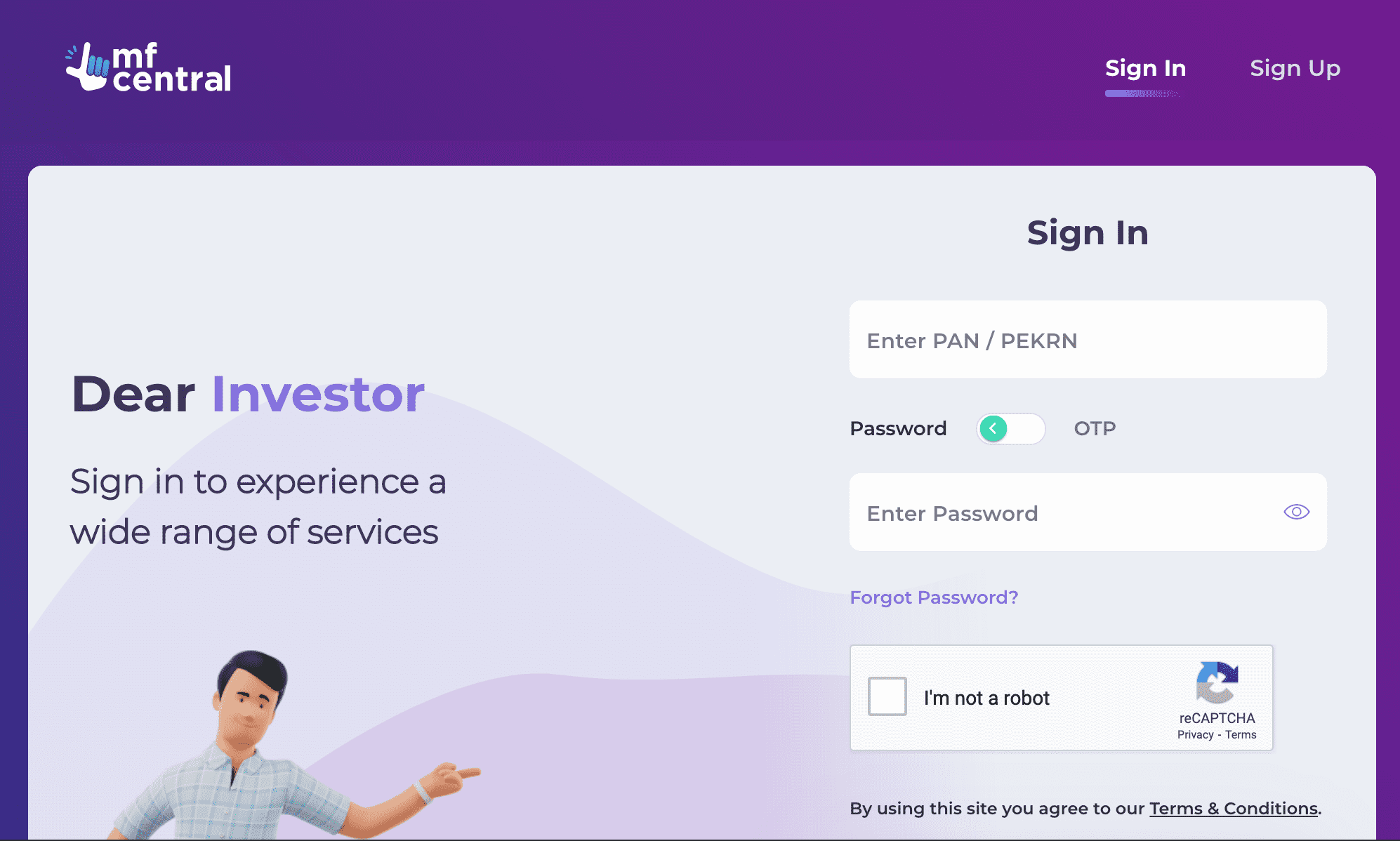

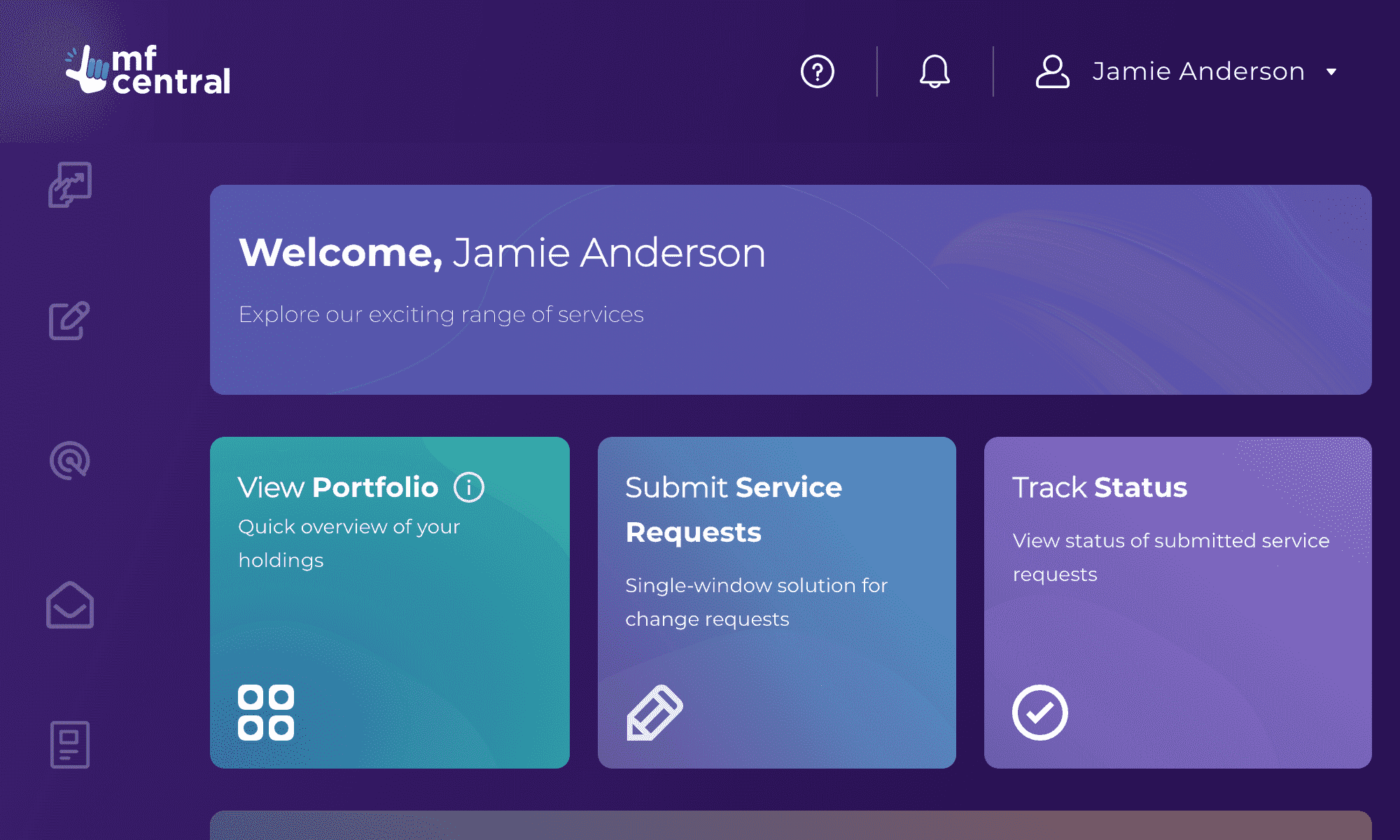

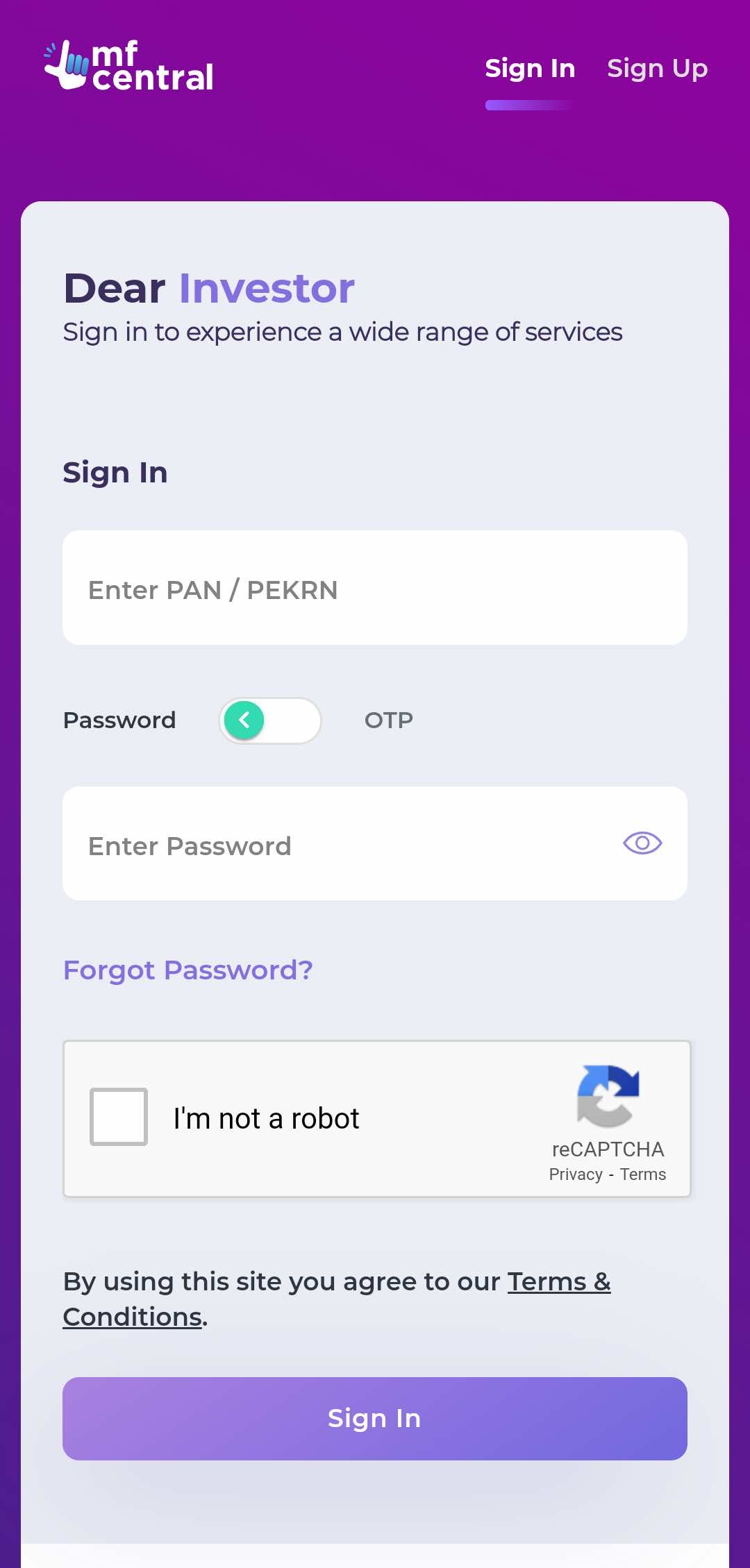

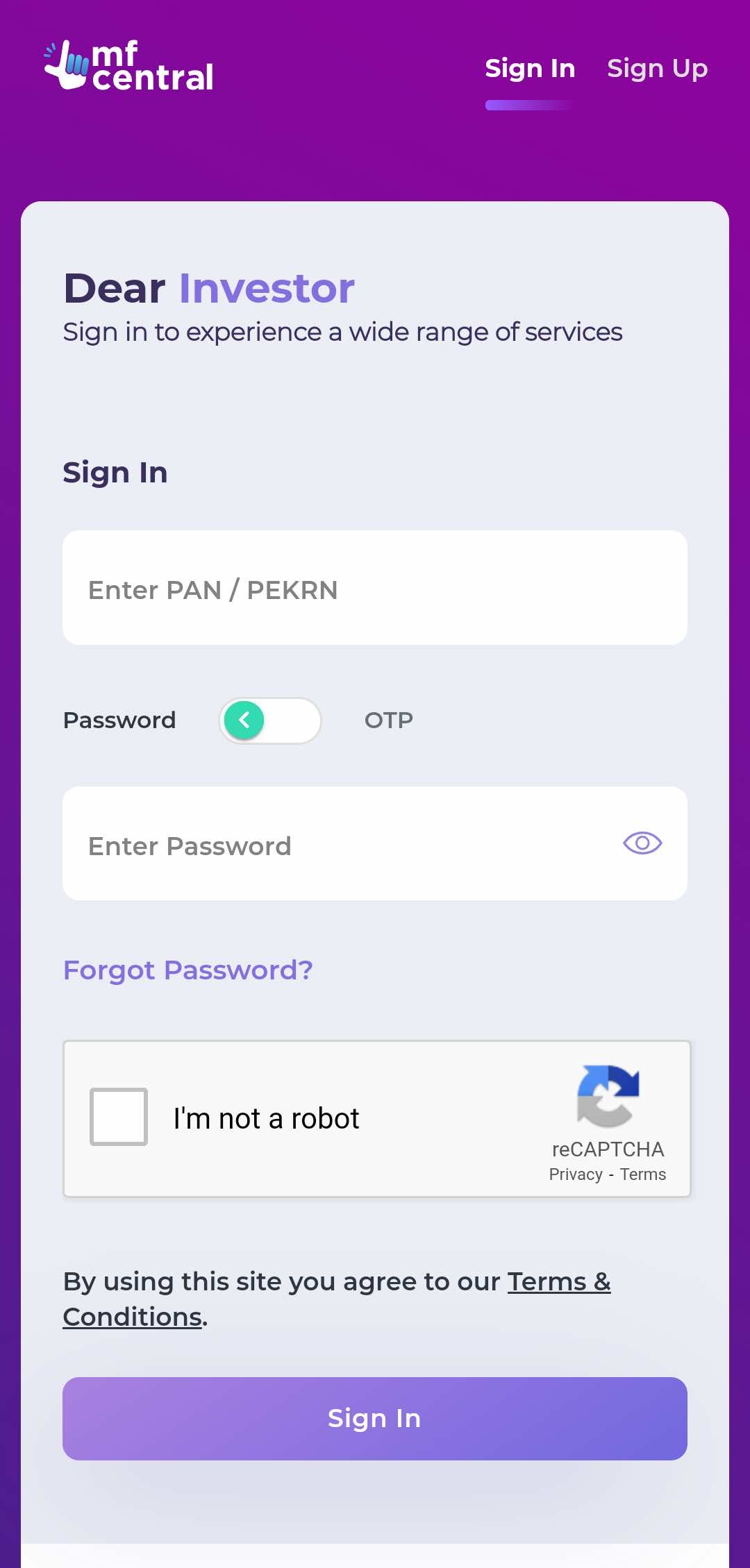

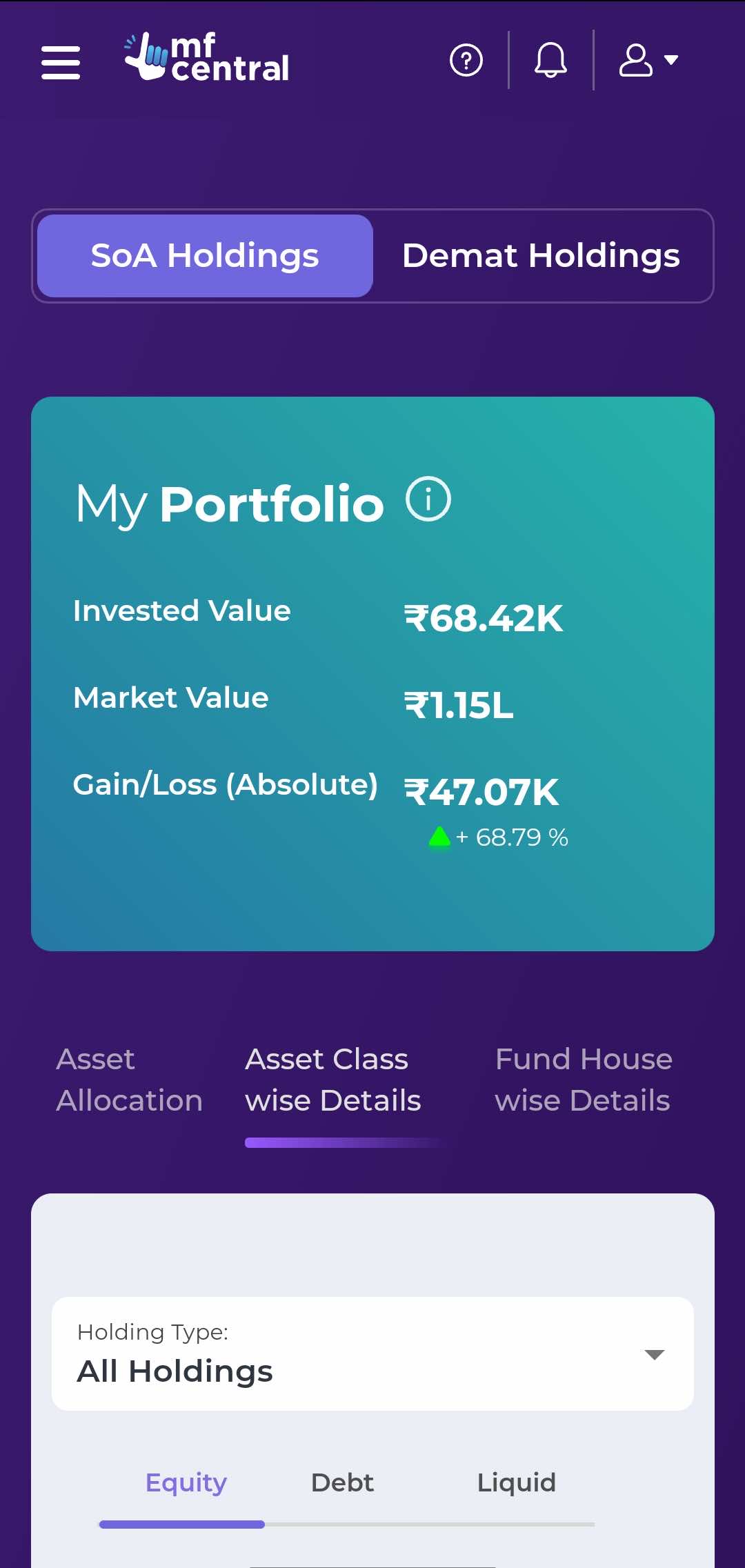

Our clients aimed to break into the Indian mutual fund industry, so the design of their solutions had to match this ambitious goal. The challenging part here was the number of users the platform was intended for. New and returning investors and other potential users, like distributors and investors seeking support, all have their specific user experience and proficiency. If the existing investors are pro users looking for advanced features to expand their capabilities, then new investors had better start from a simpler UI. Meanwhile, distributors acting on behalf of the investors require a whole new user flow.

Multiple stakeholders challenge

In the course of the project, we dealt with multiple stakeholders, including RTA's, fund houses, SEBI and the clients’ legal teams. While every stakeholder wants their voices to be heard, our task was to make a remarkable product that would stand out in the market. When treated improperly, balancing various parties may hinder the entire project or postpone its release. However, the accurately chosen strategy allowed us to satisfy the needs of each stakeholder and deliver the project without delays.

Solution

Entrusted with the full-cycle software solution development, we broke this project down into several stages, pursued the advanced approach to system design and development, coped with legislative and regulatory restrictions, and more. That’s how we achieved it.

Full-cycle software development

Ideation - Our team did competitor analysis, worked on user personas, and communicated closely with the client to identify and document business requirements.

Design - We created mind maps describing the entire scope in detail. Next, we designed branding elements, including logo, colors, fonts, and more.

UI/UX - Based on the results of the previous stages, we prepared high-fidelity mockups and workflows. Later on, we transformed those mockups into a functioning prototype showcasing main user flows and branding elements.

Development - First, we successfully approved prototypes with numerous stakeholders, including clients’ business and marcomm departments, along with regulatory bodies. Then, we incorporated their feedback into the prototypes and handed over the baton to our engineering team.

Quality Assurance - Based on the results of the previous stages, we prepared high-fidelity mockups and workflows. Later on, we transformed those mockups into a functioning prototype showcasing main user flows and branding elements.

Fast time to market

Thanks to the joint efforts of our team and all the stakeholders, we managed to launch the first part of the project in only three months. The second part—a mobile app—was deployed only one month after the web version was rolled out. Given the number of project stakeholders, platform complexity, and the fact that it was the first-of-its-kind app in the history of Indian mutual funds, the time to market was remarkably fast.

Modular approach

We also pursue a modular approach to software development. It means that we built the system components in such a way that their code, being written once, can then be reused when adding new features or functionality. Even though this approach requires extensive technical expertise, its benefits are worth the effort. It helped us to reuse the components in multiple places of the platform and avoid redundant code.

Advanced features

Finally, we added some advanced features, including integration with ecosystem partners and improved performance by reducing the number of API calls.

Legal guidelines

Mutual funds are the sphere that is severely monitored and regulated by SEBI and other governmental bodies, which means we have to react to new regulations immediately. For example, we did so concerning new guidelines on pool accounts.Previously, the businesses could hold customer funds in their account for a couple of days before transferring them to the fund house. The new guideline on pool accounts demanded an immediate transfer. So, we worked with payment gateways to create new workflows during payment, allowing the transfer of money invested by a customer to the fund house immediately.

Team composition

The project team followed the Kanban approach and had the following professionals on board:

- 1 chief technical architect

- 1 senior program manager

- 1 technical lead

- 1 UI/UX lead

- 1 UI/UX designer

- 2 senior software engineers

Results

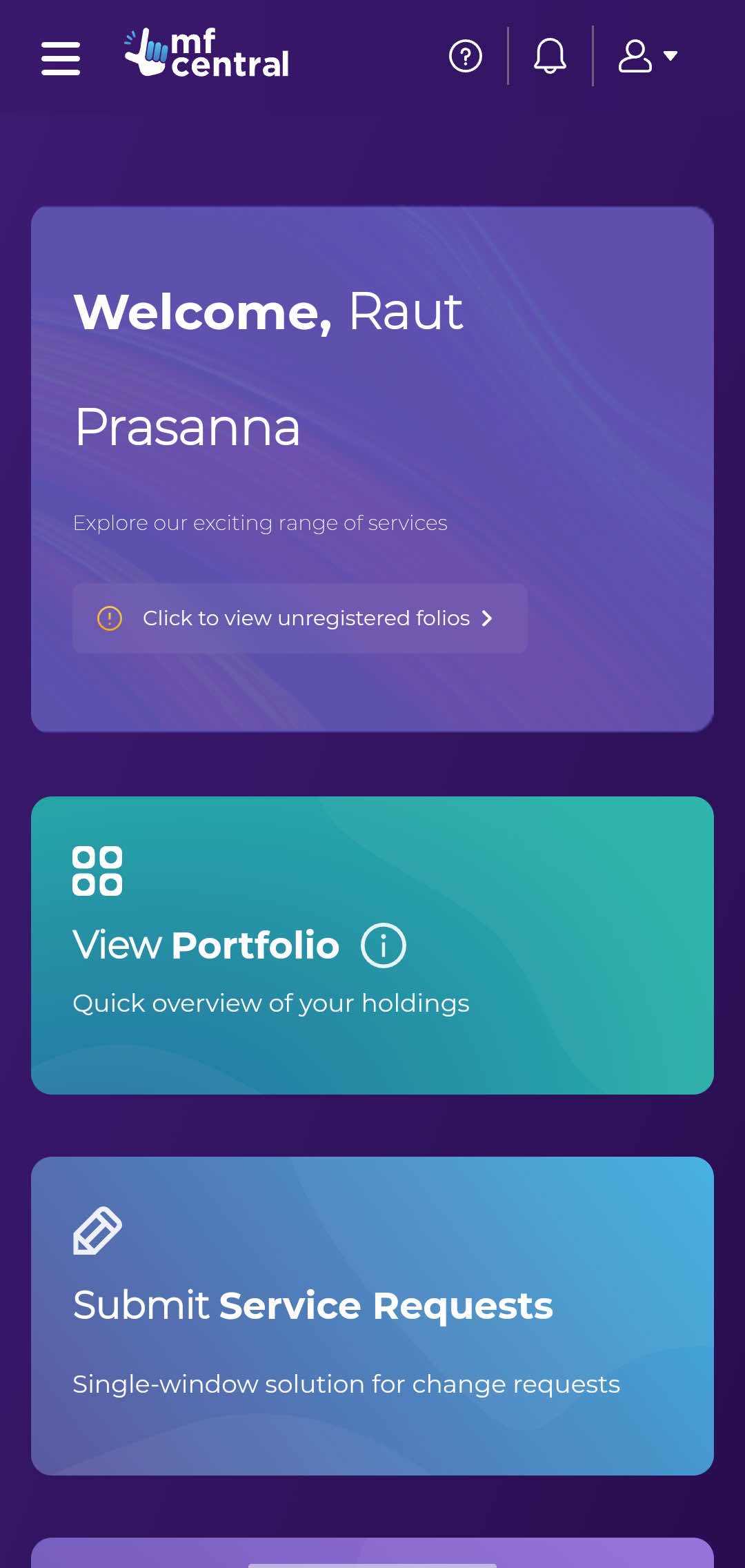

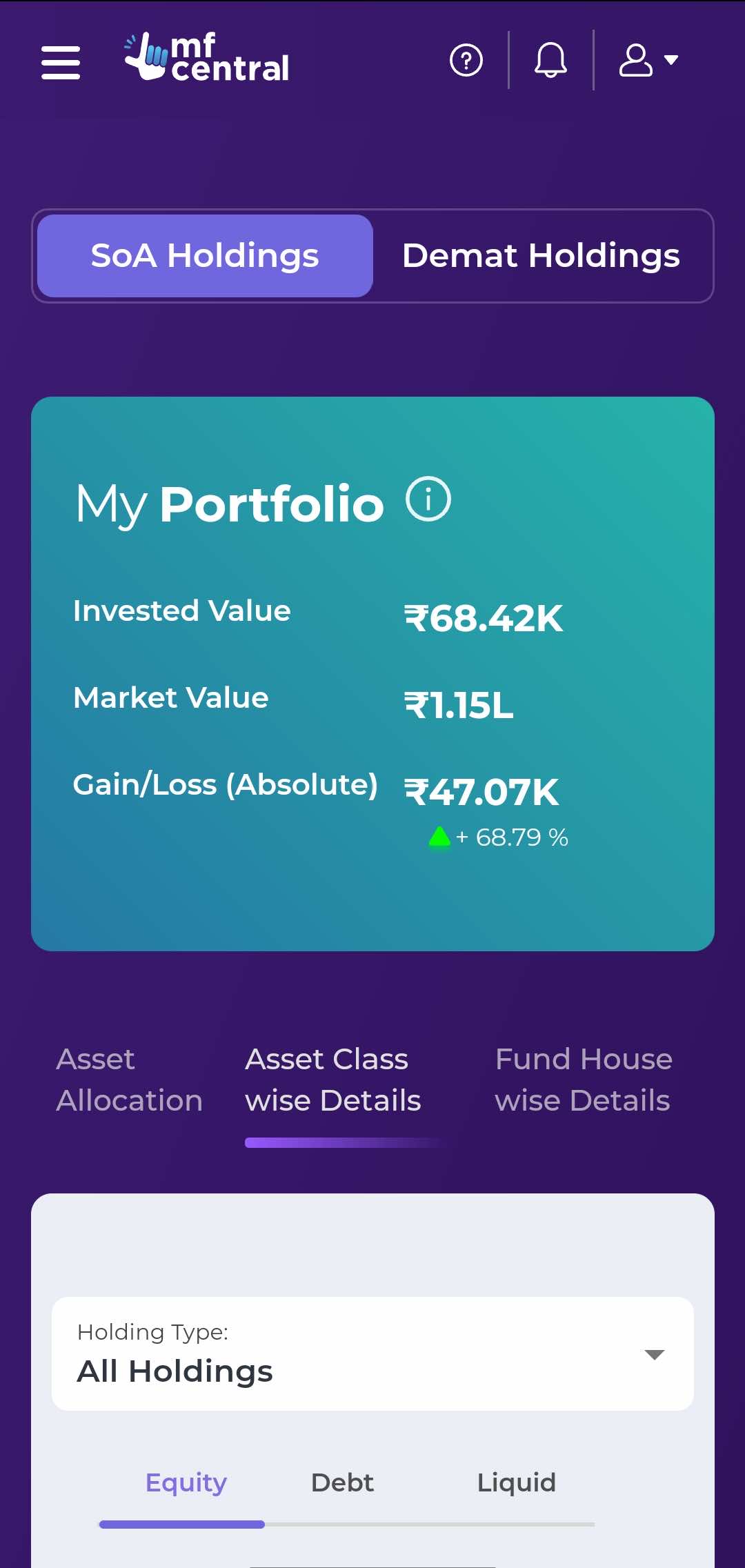

The Indian mutual fund industry players now leverage a single gateway for sleek services across all mutual funds.

Asset management companies, transfer agents, and other intermediaries and investors got an advanced digital instrument to do business.

The platform we developed is a stable and scalable solution that allows for exponential growth expected in the mutual fund industry.

It is no longer necessary to check on multiple industry players to access investment portfolios, statements, requests, tracking status, or investments—everything is now accessible through one digital window.

Future plans

The project is still ongoing, as the clients discuss new features and enhancements with our team.

Sincere thanks to Webile team for great efforts so far on MFCentral – amazing commitment and leadership. I have no words but just say great team and thanks a lot. We have a long way to go on this program but I am very confident from design , UI/ UX you have really come to lead across RTA’s.